Our work suggests that the recession currently priced into the equity market has not yet materialized. In fact, there are some positive signs that this economy will not collapse without a fight. For example, we are seeing early signs of easing inflationary pressures. This does not mean an immediate reduction in inflation, but we believe that price pressures will approach their long-term average over the next two years. For example, economic growth in the United States, although not in recession, has slowed below its long-term potential growth rate of 2%. An economy operating above its long-term potential, as the United States was until recently, increases inflationary pressure. With commodity prices reversing, broad money (M2) growth rate declining and market-based inflation expectations falling, it seems the US Federal Reserve (Fed) has not not have to move much more than it already has for comfortable inflationary pressures (illustration 1). We estimate that inflation should fall back to long-term trends over the next two years. Therefore, we also believe that the biggest increases in long-term interest rates, including mortgage rates, may be behind us.

At the same time, household balance sheets are healthy overall. For example, household debt to GDP, which is a measure of indebtedness relative to the size of the overall economy, is twenty percentage points lower than it was at the height of the housing boom. (illustration 2). It is important to note that households are in a much stronger financial position than before the global financial crisis (GFC).

As the heart of the US economy, strong household balance sheets make our economy more resilient to shocks.

Content continues below ad

With respect to house building specifically, we can compare trends in building to household formation over time to see if the housing industry has been overbuilt and is expected to decline, or if there is a enough demand for more growth to come. For example, over the period 1996-2006, our analysis suggests that the housing industry overbuilt by building 3.9 million more new homes than the rate of new household formation.

After the collapse of the housing boom in the GFC, the housing industry built far less housing than would be enough to meet the demand for the annual formation of new households. For example, from 2007 to 2019, the industry built 4.9 million fewer new homes than would be needed to meet the demand from new households. As a result, housing construction is only returning to normal rates and is unlikely to collapse given the overall strength of household balance sheets (Figure 3).

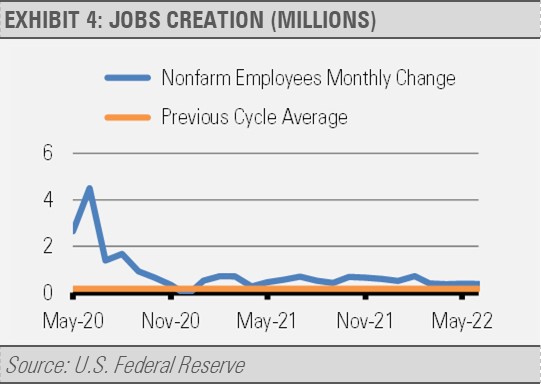

Although US economic growth has slowed, recent data, such as employment reports and business surveys, suggest the economy has not tipped into a recession. For example, the June jobs report showed the creation of 372,000 additional jobs in the United States. In fact, the economy added over 2.7 million jobs in the first half of this year. Since the beginning of the current economic cycle in May 2020, monthly job creation has been well above the 167,938 jobs created on average per month during the previous economic cycle from July 2009 to February 2020.

Additionally, we can consider the economically weighted composite of PMIs as a broad measure of economic activity. The latest reading of this measure, which is just below the average of the previous economic cycle, shows a slow pace of growth.

Yet economic growth persists. In fact, the decline in GDP in the first quarter of 2022 was mainly due to a jump in imports relative to exports which we believe has reversed. This reversal should give a boost to overall growth. Even slow growth leads to increased business revenue and profits over time.

INVESTMENT IMPACTS

We find attractive investment opportunities while managing risk in real time. To help manage geopolitical risks and market uncertainties, we are holding more cash than usual by reducing our exposure to foreign equities. This cash can help smooth out market volatility while giving us dry powder to put to work when we find new opportunities. Additionally, some of the investments we have made tend to be significantly less volatile than the broader stock market. These investments include floating rate preferred stocks, low volatility stocks and healthcare companies. Meanwhile, we are finding favorable investment opportunities in the US financial sector as well as small cap value stocks. On the fixed income side, we increased our exposures to core bonds and taxable municipal bonds to raise our high-quality yield to more attractive levels now that long-term interest rates have risen.

In conclusion, we believe that US equity markets have priced in an extremely high probability of a recession. It’s as if the US stock market predicted a recession, but the economy chose not to participate. Instead, we believe we are experiencing valuation compression based on higher interest rates.

Once the market realizes that recession risks may be premature, we expect our equity positions to do very well. In addition, rising rates could provide some long-awaited opportunities in fixed income markets. Our bond allocations are still underweight to interest rate sensitivity, so they should continue to hold up better than the broader bond market if interest rates rise. We have been able to buy high quality fixed income assets at attractive yields that will help generate strong current income while acting as a buffer against the stock market risk we seek in our investment grade holdings.

CASH INDICATOR

The Liquidity Indicator (CI) is useful in helping us gauge potential volatility, which includes current market stress. Although still elevated by historical standards, the IC has pulled back significantly over the past few weeks as market tensions have eased somewhat.

The environment is changing and we expect volatility to normalize over time. These results are also consistent with our fundamental work which indicates that this is a market correction that is coming to an end and should not turn into a protracted crisis.

DISCLOSURES

All forecasts, figures, opinions or investment techniques and strategies explained are those of Stringer Asset Management, LLC as of the date of publication. They are believed to be accurate at the time of writing, but no guarantee of accuracy is given and no liability for errors or omissions is accepted. They are subject to change without reference or notification. The opinions contained herein should not be considered advice or a recommendation to buy or sell an investment and the document should not be considered to contain sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate according to market conditions and tax arrangements and investors may not get back the full amount invested.

Past performance and returns may not be a reliable indication of future performance. Actual performance may be higher or lower than stated performance.

The securities identified and described may not represent all securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified has been or will be profitable.

The data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.