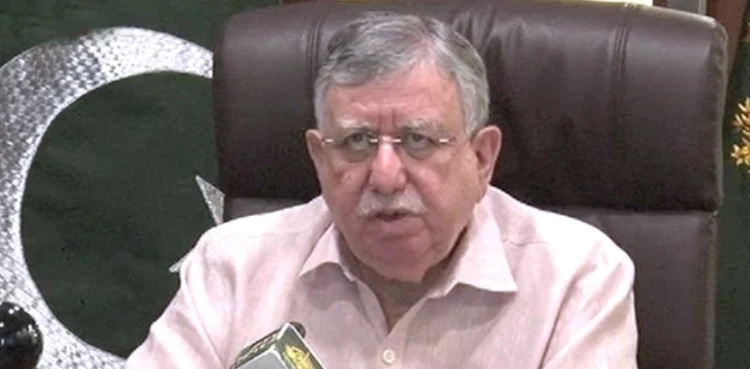

KARACHI: Former Finance Minister Shaukat Tarin warned on Saturday that gasoline prices will see an extraordinary 53% hike while more taxes will also be imposed by the government, ARY NEWS reported.

Speaking to a presser in Karachi, Shaukat Tarin said the hike in petrol prices and taxes will come under the IMF deal signed by the incumbent government.

“They signed a tough deal with the IMF,” he said, adding that even that didn’t help the rupiah which rallied slightly against the US dollar for just two days and since then the greenback made a stronger comeback.

He claimed that the incumbent government secured a $9.4 billion loan in four months. “We never bowed to the IMF and instead fought with them to ask our people for help.”

Shaukat Tarin called on the government to refrain from immediately raising electricity and gas prices as the country is devastated by flash floods. “Raise utility rates in stages rather than all at once,” he said. suggested.

He further offered a helping hand to the government and said the whole nation must unite in the face of the floods. “We are ready to work with them to deal with the flooding situation,” Tarin said.

Agreement with the IMF

The International Monetary Fund (IMF) placed tougher structural benchmarks for Pakistan as part of the implementation plan to qualify the next loan tranches, amounting to $3 billion on Saturday.

According to a report on the completion of the seventh and eighth reviews of the Extended Financing Facility (EFF), the global lender has imposed eight tougher targets on Pakistan in addition to giving new deadlines to meet actions.

For the revival of the IMF program, the IMF has requested Pakistan to ensure that the tax and asset details of bureaucrats, cabinet members and parliamentarians are filed electronically and make them accessible to the public.

The Fund has called on the government to end subsidies given under the government led by Imran Khan. The IMF has asked the country to increase the tax on petroleum products from Rs30 to Rs50.

The report further stated that 855 billion rupees should be collected from the people by increasing the tax on petroleum.

The government has also undertaken to ensure the restoration of the general sales tax (GST) on petroleum products. “A 10.5% sales tax will be levied on petroleum products,” the report said.

Meanwhile, the electricity tariff would reach up to 26 rupees per unit as the IMF ordered subsidized electricity tariffs to be cut drastically.