The carnage in Russian stocks continued on Wednesday as the market fought its way through the nascent economic war between Russia and the West. Sanctions imposed by G7 countries have so far focused on assets held abroad by Russian nationals and the ability of Russian institutions to do business with the rest of the world. The sanctions prevent any type of transactions with most Russian financial institutions, direct investment in Russian companies and the purchase of new Russian debt.

But a close reading of Canada’s economic sanctions (summarized with permission from Osler Law) shows that there is technically no ban on holding Russian corporate stock or debt that was issued before the passage. sanctions, which makes sense. Western investors who bought part of the world’s largest gas company (Gazprom) or the world’s largest nickel producer (Norilsk) were not trying to fund Putin’s empire building. They were there for some good old fashioned greed!

Criminalizing Russian securities products would put all sorts of big pools of money in a legal pinch, and freezing them would prevent asset managers from doing what everyone wants and expects of them during this first round of sanctions. : to sell.

The Moscow Stock Exchange (“MOEX”), where most of these securities have their primary listing, is closed for now and will likely remain so for the foreseeable future. But quotes for those companies’ certificates of deposit that trade on other exchanges and as part of ETFs are collapsing under pressure from positions that former holders are now reluctant to admit they owned in the first place.

Pension money managed for the glory and benefit of the Canadian proletariat.

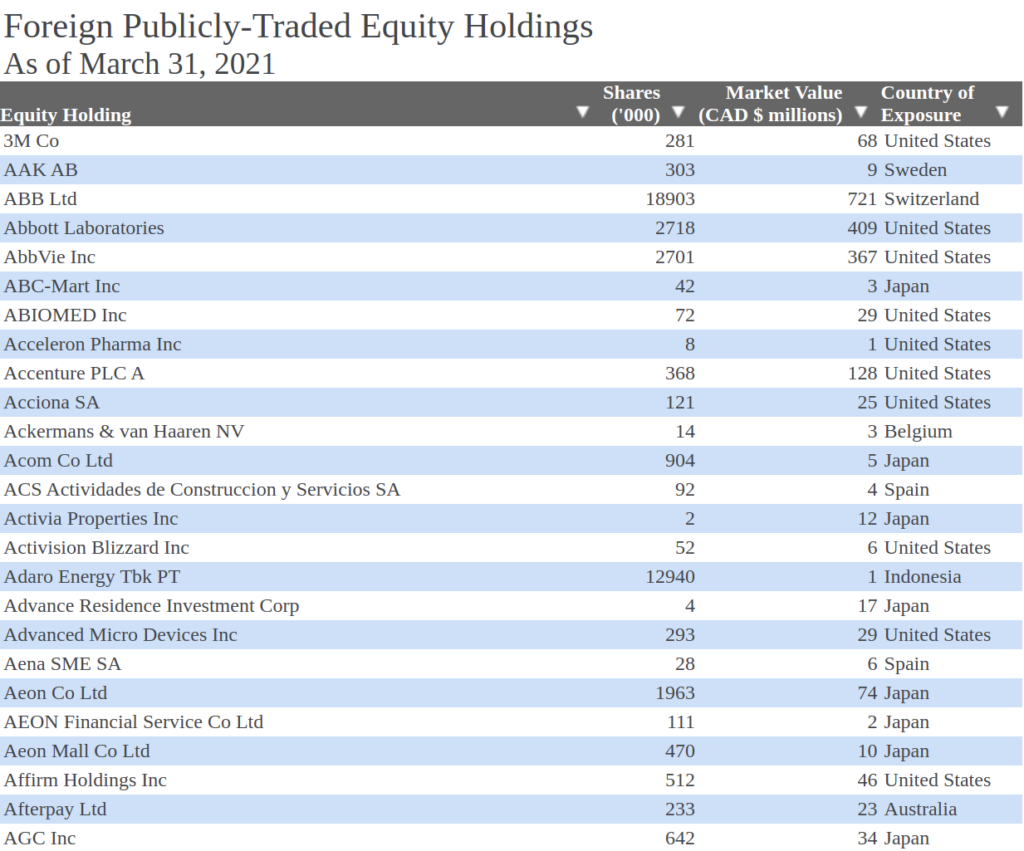

With net assets of $479.2 billion and assets under management of $627.9 billion as of March 31, 2021, the Canada Pension Plan is the largest pension plan in Canada. The fund is managed by CPP Investments, a Crown corporation. In order to “maintain transparency and accountability to stakeholders”, CPP Investments publishes a list of the foreign equity products it holds on its website and updates it once a year when it publishes its year-end financial statements. The RPC’s fiscal year ends on March 31.

This list of foreign stocks, supplemented by a handy “Country of exposure” column, currently shows that the pension plan holds no Russian assets at the end of its last fiscal year. But at 9:20 a.m. PST on Friday, February 25, Twitter user @rohanarazel was under the impression that the DID pension plan owned Russian assets and posted a screenshot of what appears to be the same page, showing as much.

At 6:29 p.m., other users were responding to Rezel’s tweet, asking where he got that listing image because, at that time, the official listing didn’t include any Russian assets.

The first casualty of war is the truth

Rezel acknowledged that the listing on the CPP website at the time was different from the one he posted, but gave no idea when he took the screenshot, or responded to the allegations. in responses that it was a fake. The deep dive contacted Razel via twitter DM to ask when he took it, and did not get a direct answer to the question. Razel pointed out that a targeted Google search of the listing’s URL for the word “Gazprom” returns results, indicating that Google crawlers once identified this word on this listing, further indicating that it has been deleted. Norilsk Nickel’s apparent position of 5,335,000 shares in the Plan, quoted at a value of C$151 million, is basically in line with the market price of Norilsk’s ADRs as of March 31, 2021.

Diving has also contacted CPP Investments’ media relations team via email to inquire whether he is currently or has ever been a Russian asset manager, and has not yet received a response. The total value of Russian stocks in this screenshot, each time it was taken, was C$1.3 billion. Its value today is considerably less.

If the Crown corporation withdrew these positions from public disclosure, was it to mitigate the bad optics of having once facilitated an Imperial aggressor, or was it because it has no intention of unloading these positions to these assessments and would rather not answer questions about why the year-end 2022 list shows an increase in these positions while the average manager is decreasing?

If Russia remains on a war footing, it will likely burn a lot of nickel.

(with files from Deep Dive Editor Jay Lutz)

Information for this briefing was found via Sedar and the companies mentioned. The author has no security or affiliation related to this organization. Not a buy or sell recommendation. Always do additional research and consult a professional before purchasing a title. The author holds no license.

Braden Maccke is a writer from British Columbia, the only member of The deep diveof the west coast contingent.