DNY59/iStock via Getty Images

The Vanguard Total International Stock ETF (NASDAQ:VXUS) is intended to track the universe of foreign equities with exposure to mega-cap leaders through to micro-cap companies. The name of the game here is diversification to capture high profile themes internationally equities as an important market segment while eliminating company-specific risks.

Even though market conditions were volatile at the start of 2022, there are plenty of reasons to maintain a positive outlook, with international equities well positioned to advance going forward. VXUS, with an expense ratio of just 0.07%, is a good choice as a core portfolio for investors who want to move beyond US-centric portfolios and ultimately improve performance. long-term risk-adjusted returns.

What is the VXUS ETF?

The VXUS ETF with over $50 billion in net assets adopts a full replication approach on the underlying “FTSE Global All Capitalization ex-US Index”. As the name suggests, the strategy considers all non-US stocks with broad exposure to developed and emerging markets. The current portfolio of 7,873 stocks from companies located in more than 46 countries highlights the broad reach of the fund.

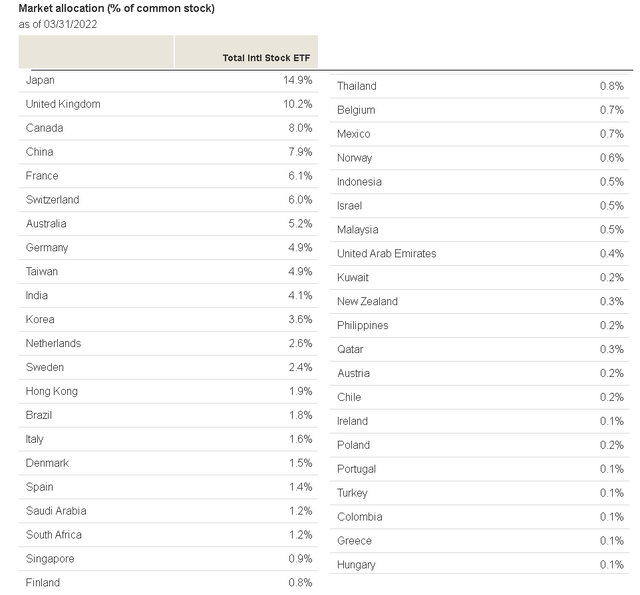

Using a free float-adjusted market capitalization weighting methodology, larger companies retain their relative importance, while smaller holdings also play a role in balancing risk and return potential. Looking at the breakdown of funds by country, the weightings here reflect the relative size of the publicly traded equity market in each region. By this measure, Japan with a 15% weighting is the best-represented country, followed by the UK at 10%, while Canada and China both make up 8% of the fund.

Source: Vanguard

About 75% of holdings are classified as from “developed markets” while 25% are in emerging countries. It is understood that developed markets, including Japan and most of Europe, have lower structural risks related to the political and business environment. On the other hand, the attraction of emerging markets is the higher growth potential.

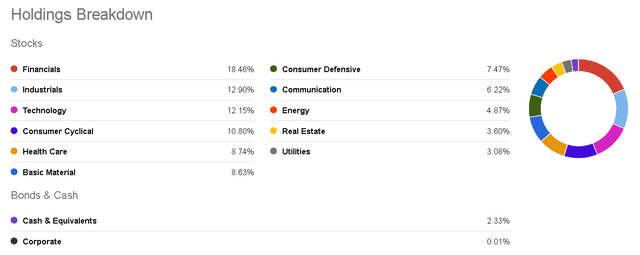

By sector, financials are the largest group with 19% of holdings. This considers that for many countries, national banks are often the largest publicly traded companies, uniquely placed to represent trends in the local economy. This is in contrast to stocks in the materials and energy sectors which together make up around 14% of the fund and which are generally valued based on trends in global commodity prices. Overall, VXUS’ exposure presents a good balance across sectors.

Looking for Alpha

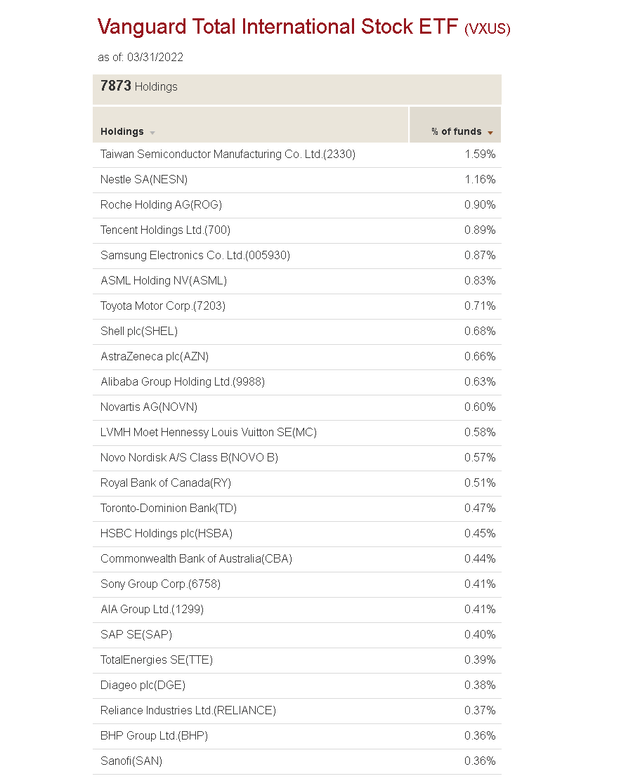

A key point here is that given the size of the portfolio with diversification pushed to an extreme level, the vast majority of stocks only have a fractional position in the fund. The main holding is Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) given its $500 billion market value, but is only 1.6% of VXUS.

The top 10 stocks have a combined weight of 9% in the fund, which contrasts with the Vanguard S&P 500 ETF (VOO), which tracks the largest US companies and the top 10 stocks total 30%, for example. The point here is to say that the underlying performance of a single holding will not necessarily move the needle of the fund when macro trends are going to be more important. In the list of top stocks, stocks here are recognized as market leaders and generally operate globally.

Source: Vanguard

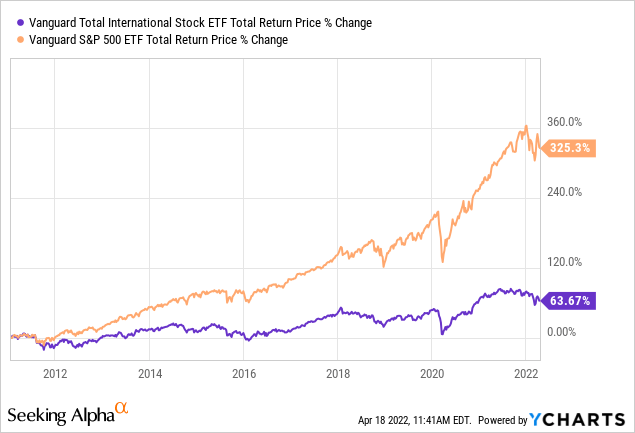

VXUS Performance History

With a fund inception date of January 2011, VXUS has faced a rocky road over the past decade. The fund generated a cumulative return of 64% over the period, representing an average annual return of around 5% per year. This is a significant underperformance against the S&P 500 which generated nearly three times the return, gaining a much stronger 325% in the same time frame. Before jumping to a conclusion, a few factors account for VXUS’ lagging performance.

In retrospect, the timing of the fund’s launch coincided near the peak of the last “commodities cycle”, as metals and energy prices fell sharply around 2015. Emerging markets within VXUS were particularly hard hit by weaker economic growth over the period.

At the same time, the US economy was overall very resilient during the 2010s, characterized by a historic bull market in equities, particularly led by innovative high-tech leaders not included in XVUS. Some of this momentum has contributed to the strength of the US dollar which has gained more than 25% over the past decade against a basket of foreign currencies.

This is important because currency risk with VXUS holdings generating sales and profits in currencies other than US dollars remains a risk for the fund. The takeaway here is not a critique of VXUS, but rather an outlook on how international equities as a market segment have continued to be volatile.

source: finviz

Obviously, if we had a crystal ball showing a certain outperforming fund or “XYZ” delivering any return, then there would be no need for VXUS or an ETF. We argue that the appeal of VXUS now is the inherent uncertainty in stocks that makes diversification so critical.

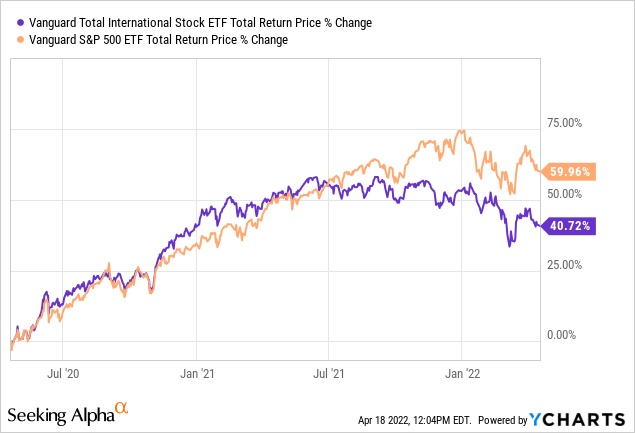

The fund’s performance looks more encouraging over the past 2 years, returning 41% versus 60% in the S&P 500. It is possible that VXUS and International stocks as a group could outperform even the S&P 500 over a period of time. given in the future.

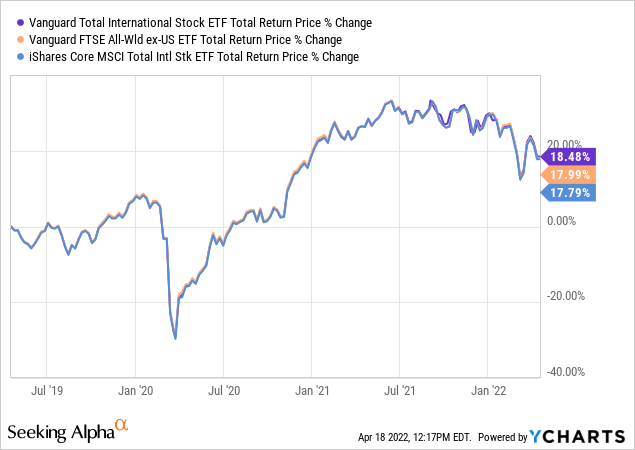

Finally, we note that the performance of VXUS, up 18.5% over the past year, is in line with other comparable “international equity” ETFs. As a benchmark, we include the iShares Core MSCI Total International Stock ETF (IXUS) and the Vanguard FTSE All-World ex-US ETF (VEU), both with a slightly lower return over the period, closer to 18%.

The reality is that these three funds are very similar in terms of strategy and market exposure, technically tracking different indices with subtle differences in methodology. That said, VXUS stands out for its larger portfolio of +7,800 holdings versus “only” 4,325 in IXUS and 3,640 in VEU. With a focus on diversification and the most comprehensive exposure, VXUS is our top pick in this category. All three funds also offer a similar dividend yield of around 3.3% via a quarterly distribution schedule.

Is VXUS a good long-term investment?

Despite the performance of international equities as a group over the past decade that leaves much to be desired, there is nothing inherently wrong with the market segment. It’s easy to get caught up in daily headlines and short-term market fluctuations. The key here is to view VXUS as a long-term investment and believe that the outlook for the next few years is positive.

In our view, the structural tailwinds that support a positive outlook for the global economy, including factors such as steady population growth and growing demand for goods and services, remain in place and could accelerate over the course of the next decade. For emerging markets in particular, expanding internet access and mobile devices for a growing middle class of consumers are long-term investment themes that remain in place. The underlying businesses within VXUS will benefit as they consolidate market share and innovate through the use of new technologies adding efficiencies across all sectors.

For the remainder of 2022, we can safely say that international equities as a group have a better setup than US companies given the current macro environment. Many countries represented in VXUS that are commodity exporters see a windfall in trading higher energy and even agricultural commodities as inflation winners. We expect these trends to continue.

This is despite recent strength in the US dollar. As the Fed takes a hawkish approach to rates, keep in mind that several global central banks, including the European Central Bank, are also on track to begin a tightening cycle. This opens the door for foreign currencies to reverse recent losses and even strengthen through 2023, adding a further boost to international equities.

Overall sentiment towards foreign equities has been extremely weak, but we think the pendulum may swing the other way. Stronger-than-expected economic growth over the next few quarters, perhaps driven by the ongoing post-pandemic return to normal, may provide further momentum to financial markets.

Is VXUS a buy, sell or hold?

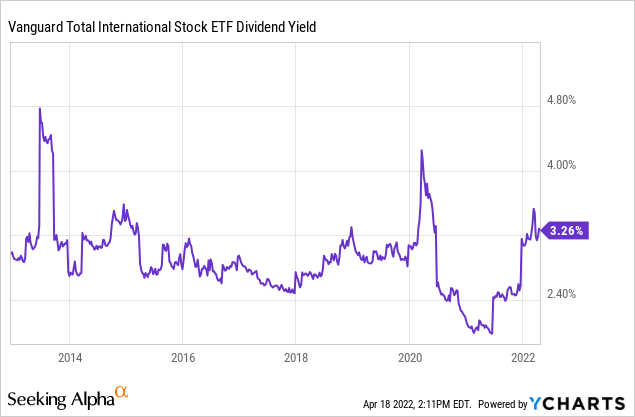

We are bullish on international equities through the VXUS ETF, as we believe recent weakness and ongoing market volatility present an attractive buying opportunity. The fund’s current 3.3% dividend yield is at a level where the fund has tended to recover over the past decade as a measure of technical support, with a few exceptions including the brief pandemic crash in beginning of 2020. By this metric, we rate VXUS as a buy with the current level as an attractive entry point for a new investment or to add to an existing position.

In terms of risk, we should be aware that international equities and broader financial markets remain exposed to global macro conditions. A deterioration in growth prospects or an extreme event such as an escalation of the ongoing conflict between Russia and Ukraine would put further pressure on sentiment towards risky assets. Currency risk is also a consideration in VXUS with the potential for a significantly stronger US dollar forcing a reassessment of global growth prospects.

Overall, VXUS is a high quality fund that performs exactly as expected for its particular exposure. We believe VXUS can be an important part of a larger portfolio as a long-term core portfolio. Our recommended strategy is to complement a core position in US stocks with a smaller position in VXUS as a diversified approach to foreign companies. From there, investors more comfortable with an active approach can look to tactically overweight certain sectors or stock-related factors based on market conditions by complementing VXUS with other more focused ETFs and even individual stocks.