Debts can pile up on you like a thief overnight. It starts off innocently enough – maybe you let your credit card balance roll around for a few months or take out a personal loan to keep you going until payday. Next thing you know, your mailbox is full of invoices.

If you’re juggling multiple credit card bills and / or unsecured loan payments, signing up for a debt consolidation plan can be a nifty way to make paying off your debt a little easier.

What Is Debt Consolidation And How Can It Help You Take Control Of Your Finances? (Watch the video at the top or read on to learn more.)

Whether you are facing a job loss, a drop in pay, or multiple mortgage and bill payments, you are not alone in experiencing cash flow issues this year, given the current economic recession.

Turning to credit card debt or personal loans can be a short-term way to deal with day-to-day costs, but the relief they provide can quickly turn sour – especially if you’re not sure you can. pay your bills in full. each month.

To make matters worse, unsecured debt, which refers to loans that are unsecured, can come with high interest rates, causing your debt to grow faster than a hungry teenager.

A good debt consolidation plan can help alleviate all of these pain points.

First of all, debt consolidation allows you to transfer all of your unsecured debt to one repayment plan. You will only have to pay one bill per month, which means less wasted time and less stress.

Then, debt consolidation allows you to take advantage of attractive interest rates, saving you money instantly. The interest rate charged by the financial institution offering the plan will replace the interest rates you previously paid.

Debt consolidation plans can also come with a longer loan term than your current loans. If you need to, you can pay off your debt at a more comfortable pace without worrying about falling behind on your payments or receiving angry phone calls from your creditors.

When you successfully apply for a debt consolidation plan, you won’t be able to take out new unsecured loans or new credit cards until your debt reaches eight times your monthly salary. But do not worry. This is only a temporary situation that allows you to avoid accumulating new loans until your existing debt is under control.

By helping you pay off your loans faster, easier, and at a lower cost, debt consolidation can be a useful tool in helping you eventually achieve financial freedom.

Just as you shouldn’t buy a new computer without understanding its features, you should know what factors to consider when evaluating a debt consolidation plan. Here are five questions you should ask yourself when choosing a debt consolidation plan.

1) What is the interest rate?

The interest rate is one of the most important factors to consider when choosing a debt consolidation plan. Simply put, a lower interest rate makes the loan cheaper for you. You should therefore try to choose a plan that offers a more competitive interest rate than what you are currently paying on your loans.

An easy hack is to use The HSBC loan calculator to calculate your monthly payments. This information can be useful when selecting a debt consolidation plan.

Banks often use the terms “flat rate” and “EIR” to describe the interest rates on their debt consolidation plans.

Flat rate interest rates are charged based on the amount of your principal. For example, if you borrow $ 10,000 at a fixed annual interest rate of 3.5%, you will pay $ 350 in interest per year.

The effective interest rate, or EIR, is usually higher than the fixed interest rate and measures the actual interest rate you actually pay taking into account all other costs incurred such as processing fees, the cost of compound interest and your repayment schedule.

The HSBC Debt Consolidation Plan offers fixed interest rates starting at 3.4% per annum. Processing fees are waived, keeping the EIR as low as 6.5 percent per year *.

2) How much are the processing fees?

One-off processing fees are charged by some banks at the start of a debt consolidation plan. These fees must be paid in a lump sum or as a percentage of the loan amount.

Processing fees make a plan more expensive for you and increase your EIR. But of course, no one wants to have to pay more money, especially when you are already in debt!

Fortunately, the HSBC Debt Consolidation Plan waives the processing fees so that you don’t have to worry about the hidden costs when transferring your debt to the plan.

3) Are you eligible to subscribe to the plan?

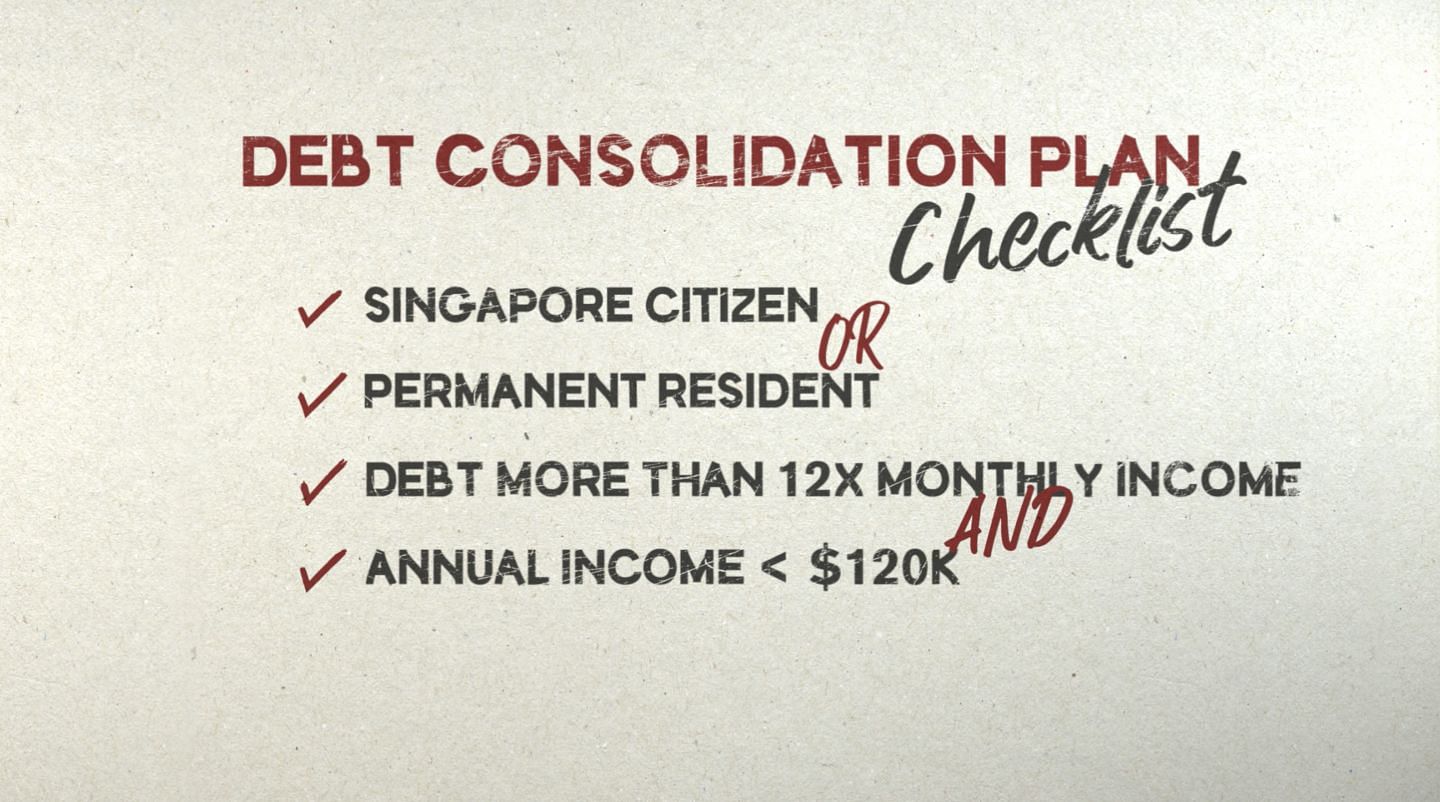

Singapore debt consolidation plans are generally intended for Singapore citizens and permanent residents only.

You will need to meet certain income requirements to successfully apply for the plan. In the case of HSBC, you must have an annual income of $ 30,000 to $ 120,000 for employees, or $ 40,000 to $ 120,000 for self-employed or commission workers.

Plus, your total credit card and unsecured loan balance should be at least 12 times your monthly income.

4) What is the term of the loan?

The term of the loan is the length of time that the debt consolidation plan will run. If you need more time to pay off your loan, you can opt for a plan with a longer loan term.

Opting for a longer loan term allows you to spread your payments over a longer period. However, note that in some cases you could end up paying more than you would under your existing agreements, even if the interest rate on the new loan is lower than what you are charged by your loan providers. current loan.

Conversely, if you are able to pay off your debt in a shorter period of time, you can opt for a shorter loan term to reduce the total amount of interest paid during the plan.

Before moving on to a debt consolidation plan, you should determine whether you will need to pay prepayment charges to your existing loan providers and carefully assess whether this new loan deal would be appropriate given your circumstances.

The HSBC Debt Consolidation Plan offers a loan term of up to 10 years, giving you the freedom to pay off your debt as quickly or as slowly as you want.

5) Are there any promotions currently?

A good promotion can sweeten the deal and save you money.

If you currently have a debt consolidation plan with another bank and decide to switch to HSBC, you will receive 5% cash back of your loan amount upon approval of your plan. *

To find out more about your financial health, you can also receive a free copy of your Credit Bureau Report sponsored by HSBC.

HSBC Debt Consolidation Plan can help you manage your debt. To know more, leave your contact details with HSBC here and a loan specialist will contact you within one business day.

* Baths and conditions of application.