[ad_1]

You may be able to increase the value of your home by hundreds of thousands of dollars just by making simple improvements. But even the simplest home improvement projects can be expensive. Consider your home renovation financing options in this analysis. (iStock)

Home renovations are a great way to add to the value of your property, while making it a more comfortable place to live. And while renovating your home might seem like a significant upfront cost, it can be more financially beneficial than you might think.

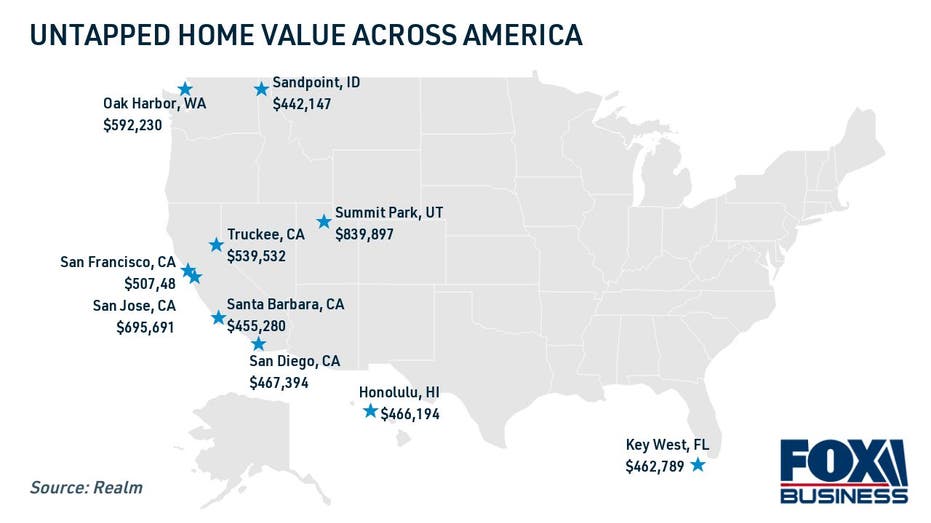

The average American homeowner is missing out on untapped potential of $ 196,199 by not renovating, according to the real estate information company Realm.

In some cities, the untapped potential is even greater. Homeowners in Summit Park, Utah have the most average untapped home equity – they’re missing nearly $ 850,000 by not updating their home. Five California cities are in the top 10, and you can see the rest of the cities with the most untapped potential on the map below:

GET A SECOND MORTGAGE? HERE’S WHAT YOU NEED TO KNOW

Even if you don’t live in one of these areas, you can still enjoy updating your home. Especially if you are planning to move in the next few years, it is important to make sure that your home is contemporary so that you can sell it for the best price.

Home renovations are an expensive upfront investment, but there are a number of ways to finance a home renovation if you don’t have the cash to cover the costs. Consider your options, including loans and refinancing, in the analysis below.

If you do decide to borrow money to finance home renovations, be sure to seek the lowest possible interest rate. You can compare rates on a variety of financial products without affecting your credit score on Credible.

5 BENEFITS OF HAVING EXCELLENT CREDIT

3 ways to pay for a home improvement project

The best way to pay for home improvements is to save up front and pay cash, but the renovation can cost tens of thousands of dollars. It may not be possible (or practical) to wait years to renovate while your home becomes more outdated. Fortunately, there are a few convenient ways to finance home renovations:

- Unsecured Home Renovation Loans

- Mortgage refinancing in cash

- Home equity loans or HELOC

Compare your options in each section below, carefully considering the pros and cons of each.

MORTGAGE ORIGINATION FEES: WHAT ARE THEY AND HOW TO AVOID THEM

Unsecured Home Renovation Loans

There are several options for borrowing home improvement loans. First, check with your county if you qualify for Home Improvement Program (HIP) loans or other federal home improvement loans through the Department of Housing and Urban Development (HUD). These types of loans may have strict eligibility requirements and program restrictions, so read the fine print to see if they are right for you.

Some homeowners also choose to borrow unsecured personal loans to finance home repairs and renovations. Unlike some of your other financing options, personal loans do not require collateral. This means that you don’t risk losing your home if you don’t pay off the loan.

Personal loans offer a lump sum loan amount that is paid off in fixed monthly installments over a set period of time, usually a few years. Funding is quick and you may be able to receive your loan in just a few business days.

Personal loan interest rates are fixed, which means they won’t increase unexpectedly after you lock in your loan terms. They also depend on your creditworthiness, so you will need to work on improving your credit score to get the lowest rates possible.

You can use a personal loan calculator to find out your monthly payment amount. If you decide that a personal loan is right for you, browse the table below to see estimated interest rates from real lenders. Get pre-qualified on Credible to see offers tailored to you without affecting your credit score.

WHEN TO USE A PERSONAL LOAN ON A CREDIT CARD

Mortgage refinancing in cash

Mortgage refinancing is the process by which you take out a new home loan to pay off your old mortgage. With your home equity at record highs across the country, you may be able to borrow a lot more than you currently owe on your mortgage.

Let’s say you have $ 200,000 left on your mortgage and your house is worth $ 300,000. You could potentially take out a new mortgage for $ 250,000 and use the additional $ 50,000 to cover home improvement costs. This way, you can get a relatively low interest rate while you are paying for home renovations.

Keep in mind that mortgage refinancing comes with closing costs. Additionally, you need to be careful about borrowing more than the actual value of your home – you cannot borrow more than your home would estimate.

Mortgage refinancing rates are nearing their all-time low, making this a great time to use cash refinance to renovate your home. You can compare mortgage refinance offers from several online lenders at a time at Credible’s online marketplace.

WHAT ARE THE NEW FHA LOAN LIMITS FOR 2021?

Home equity loans vs HELOCs

Another common way to pay for home renovations is through a Home Equity Loan or Home Equity Line of Credit (HELOC). Home equity loans and HELOCs allow you to borrow against the equity you have built up in your home. But while cash-out refinancing replaces your home loan with a new one, home equity loans are actually a second loan on top of your first mortgage.

Your current mortgage rate and repayment term will remain the same, and your home equity loan or HELOC will have new terms. Home equity loans allow you to borrow a lump sum of cash, and HELOCs are revolving lines of credit that you can withdraw as you see fit. Both are types of secured loans that use your home as collateral, so you have the potential to lose the roof over your head if you don’t pay off the loan.

The amount you can borrow on a home equity loan will depend on your credit score, Debt-to-Income Ratio (DTI), and Loan-to-Value Ratio (LTV).

Learn more about using and calculating your home equity on Credible.

4 CREDIT UNITS TO CONSIDER WHEN REFINANCING STUDENT LOANS

Have a finance-related question, but don’t know who to ask? Email the Credible Money Expert at [email protected] and your question could be answered by Credible in our Money Expert column.

[ad_2]