cemagraphy

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on September 2, 2022.

PGIM Global High Yield Fund (NYSE: GHY) is a high yield bond fund with a fairly high exposure to global positions. High yield bonds may offer a bit more protection against higher interest rates compared to their higher quality counterparts. They often trade with a higher correlation to equity investments, but are sufficiently differentiated to be part of any diversified portfolio.

One of my main concerns with GHY was the distribution of the fund. Mainly, the lack of coverage for the cast was only going to get worse. That’s what’s happening now, with somewhat weaker coverage. It is set to get worse now that the fund has been deleveraged. This is not a forced debt reduction but a choice of the management team.

Of course, they could have deleveraged at the perfect time to nab cheaper bonds before they potentially rebounded. This could be the room they were looking at. I think this will eventually hurt the fund and a reduction in distribution is more likely now.

The basics

- Z-score over 1 year: -0.32

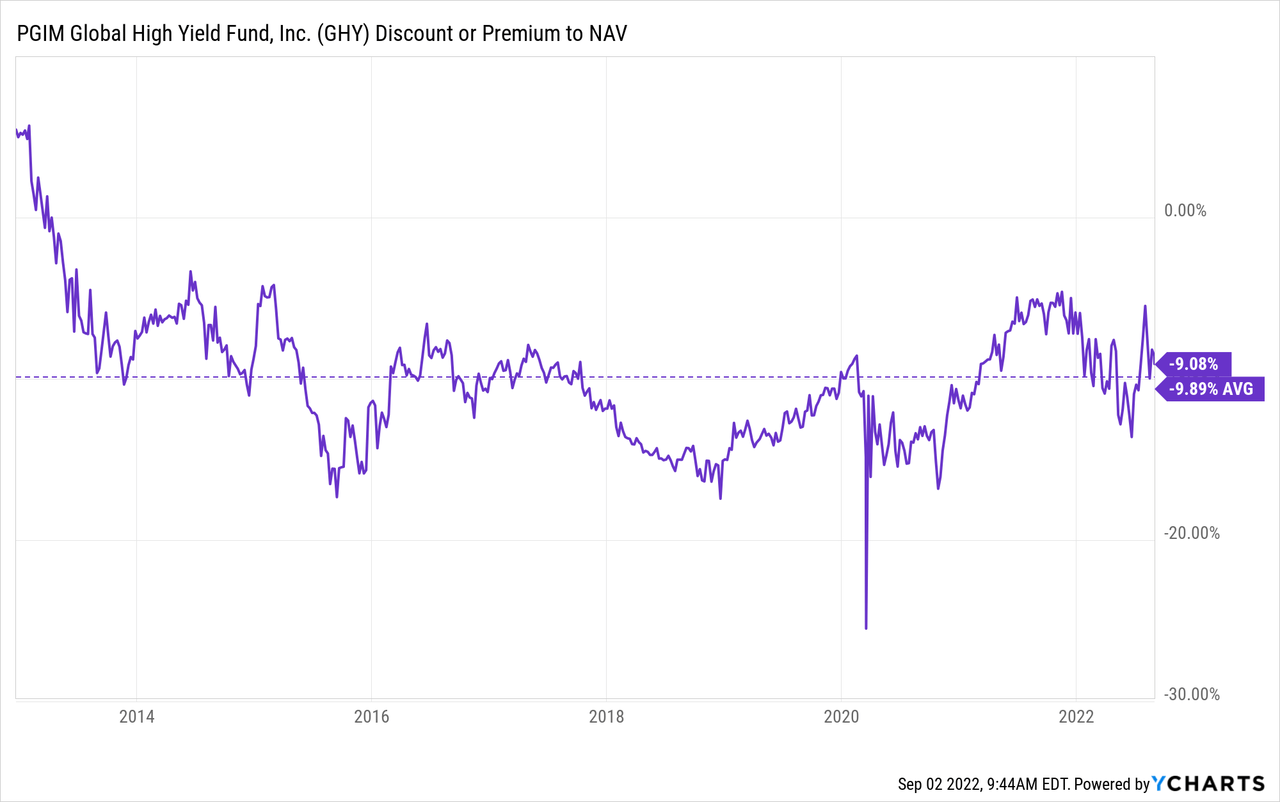

- Discount: 9.08%

- Distribution yield: 10.84%

- Expense ratio: 1.28%

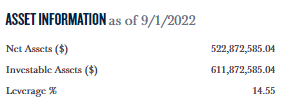

- Leverage: 14.55%

- Assets under management: $611.873 million

- Structure: Perpetual

GHY look for “to provide a high level of current income by investing primarily in below investment grade fixed income instruments of issuers located anywhere in the world, including emerging markets.”

This is a fairly straightforward high yield bond fund with greater flexibility to invest more internationally. Investing outside the US can help provide greater diversification for investors, eliminating the “country of origin bias”. In a previous post on GHY, I noted how highly correlated it was with its US counterpart, PGIM High Yield Bond Fund (ISD). So, despite its global focus, these two had historically shown a strong correlation.

The fund had borrowings of $149 million at the end of January 31, 2022. That was down from the $249 million it had at the end of its previous fiscal year. Now they have reduced their debt levels again. They seem to only have ~$89 million in borrowings right now.

However, this was not done all at once. Interestingly, their last N-PORT deposit showed borrowings at $129 million. This was reported on April 29.

GHY Portfolio Assets (PGIM)

The debit interest rate is based on 1 month LIBOR plus 0.75%. At the end of their last semi-annual report, it averaged 0.84%. As the rates increase, the costs will also increase here. It will, of course, be offset now by the reduction in GHY’s global borrowings.

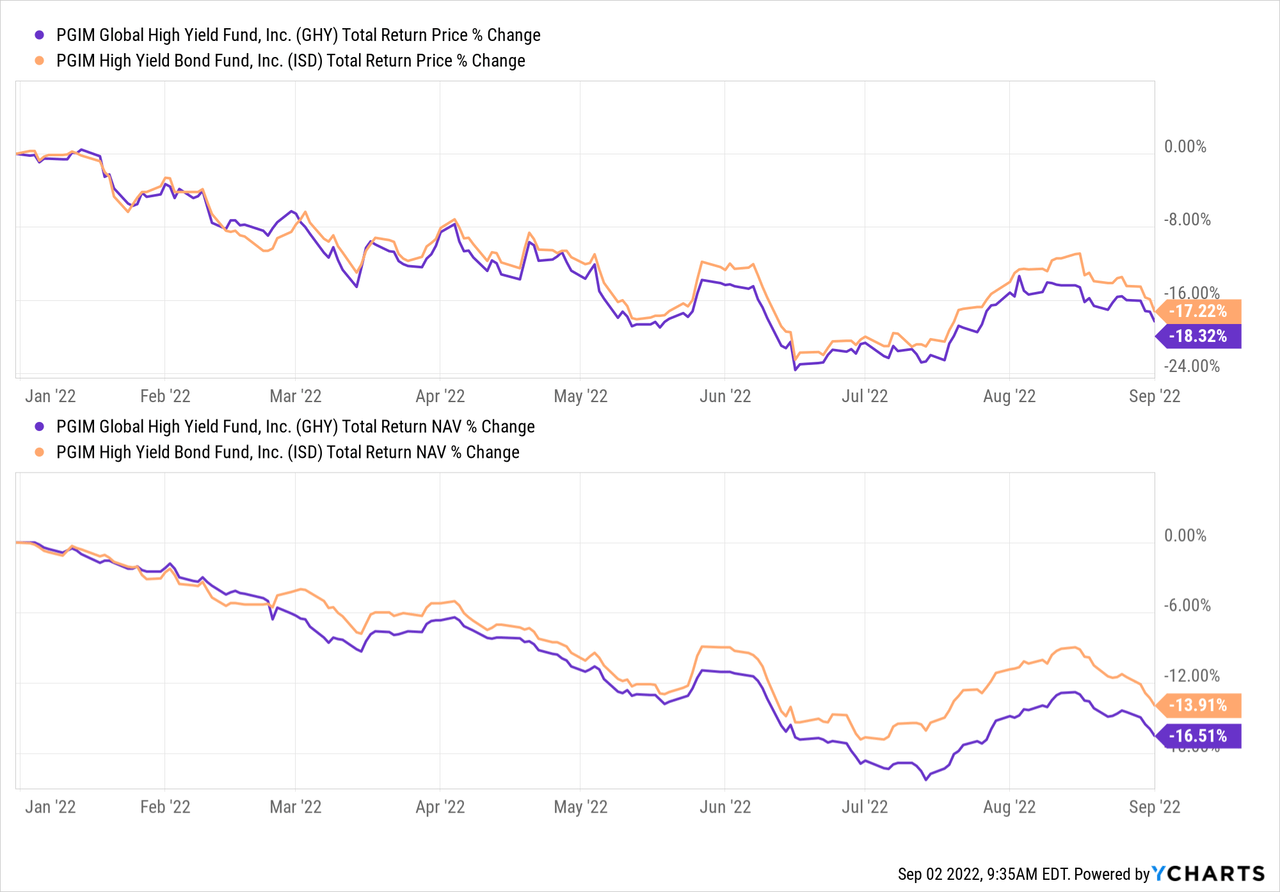

Performance – Insufficient results due to credit risks

The fund appears to continue to act quite similarly to its sister fund, ISD. On a total return price basis, it’s actually very close. Based on total net asset value return, YTD has been a bit divergent in recent months.

Y-Charts

Higher interest rates are pushing these funds lower, but their focus on high-yield investments also means credit risks are rising. The fund’s holdings will be watched more closely for potential defaults with a weaker economy. They are high return investments for a reason. These are not financially sound companies; they will be disproportionately affected during a slower economy.

The fund’s discount partially compensates for this at this stage. The underlying declines in the fund’s portfolio also explain this increased risk. We are looking at a fund that is heavily discounted, plus underlying bonds that are discounted. This combines to put GHY in quite an attractive position in terms of valuation.

Longer term, the fund is trading just off its longer term discount average. For this reason, I would still like to see a deeper discount before I find this fund even more attractive.

Ychart

Distribution – Coverage goes in the wrong direction

The fund’s distribution yield is 10.84%, with a NAV yield of 9.86%.

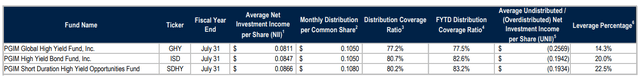

Earlier this year, we looked at the fund’s distribution coverage. The FYTD coverage rate was 78.3%. This blanket now has slipped a little further at 77.5%.

Admittedly, it is holding up better than I thought, given the deleveraging. However, the full impact of deleveraging, I think, is not yet fully understood.

GHY Revenue Report (PGIM)

This fund’s fiscal year-end is July 31, which puts this final level of coverage at what it produced for the full year. FYTD stands for Year-to-Date, the latest report being July 31, 2022. This is for the full year.

Since the deleveraging process took place between January 31, 2022 and September 1, 2022, the impact can be further reflected in the next report. As we noted above, it seemed to be a process of deleveraging throughout the period, not all at once.

This lack of coverage is similar to what we’ve seen with previous reports from the fund now.

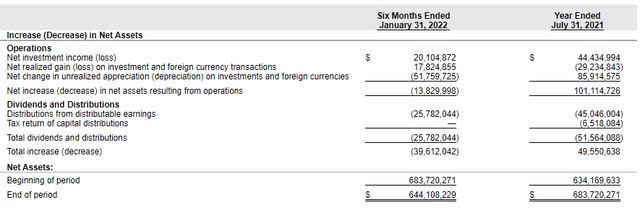

Half-year report GHY (PGIM)

In their previous semi-annual report, NII coverage was 77.9% and that of the previous year was 86.17%. The coverage continued to drop and they continue to pay the same distribution. However, it should be noted that the fund realized more than enough capital gains in the six months to effectively ‘cover’ its distribution. We often view equity funds using capital gains as a more reliable way to fund a distribution. For fixed income funds, we would ideally see NII hedging instead.

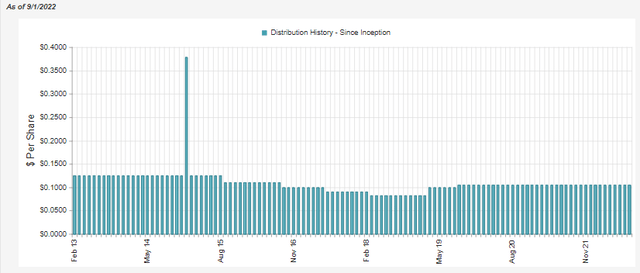

GHY distribution history (CEFConnect)

At some point, the higher yields will pay off if rates continue to rise. However, the negative impacts on the fund’s underlying portfolio set in before higher income can be generated.

As they continue to pump out the same distribution – while a regular distribution is highly valued – it becomes more difficult for the fund to take advantage of those higher returns when they arise. This would be because the fund is paying out capital now; it could otherwise stay invested. They once again announced that they were maintaining same distribution for the following quarter.

GHY Portfolio

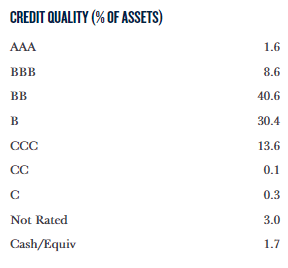

Bonds rated double and single B dominate the fund’s portfolio. That’s pretty standard for high-yield bond funds. In fact, I recently updated my thoughts on the New America High Income Fund (HYB), which has many similarities in credit ratings and portfolio positioning. At the same time, the fund fully covers its distribution, but with significantly higher leverage and a lower yield.

The fund actually operates a little more in the investment category, although it is quite small overall. This was to be expected as it is after all a “high yield” fund. The average maturity of the portfolio is 6.4 years, with a leverage-adjusted duration of 4.6 years. Data is provided as of July 31, 2022.

GHY credit quality (PGIM)

Since the previous update, it looks like they’ve reduced some of their CCC exposure. At the same time, they increased AAA and BBB (investment grade weightings) and increased BBB and B more significantly. This could be a reflection of the fund’s deleveraging of riskier assets. This is why deleveraging, even if it harms distribution coverage, could still be useful in a recession. That would be when they could put that capital back to work in higher yields or businesses that survive a recession.

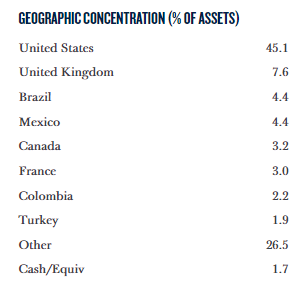

GHY’s portfolio also goes much deeper than US investments. The bulk of the portfolio is actually outside of the US, despite the actual significant weighting in US-based companies. This fund could offer an investor more of those global assets that one is potentially looking for. That being said, we have seen an increase in its positioning in the US with this latest update. Perhaps the shift to higher quality names also meant a shift to US assets.

Geographic allocation GHY (PGIM)

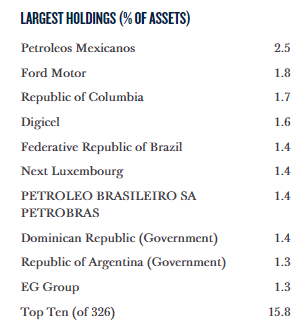

The top ten and the overall portfolio still show that the fund is highly diversified, with 326 holdings. The top ten represent 15.8% of the portfolio.

GHY Top 10 (PGIM)

Their exposure to Ukrainian public debt is through 12 different positions, but it only represents 0.37%. The fund is not exposed to Russian public debt.

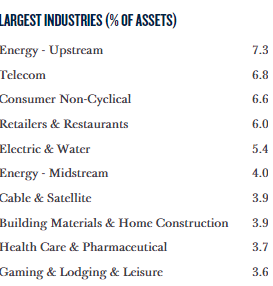

For sector weightings, we also see a good mix in this case. Again, a similarity to HYB is that energy is the industry’s largest allocation.

GHY Industry Allocation (PGIM)

Conclusion

GHY continues to have low distribution coverage which will only decline further. At the same time, investors might have appreciated seeing their leverage decrease. This means that they have more ability in the future to take advantage of further declines in bond prices if they occur. This certainly seems like a likely case, as the Fed looks set to continue raising interest rates, even if it means “a bit of pain.” Overall, it’s an attractive fund, but I’d like to see its discount widen further to compensate for the additional risk. At present, we are close to its longer-term average valuation.