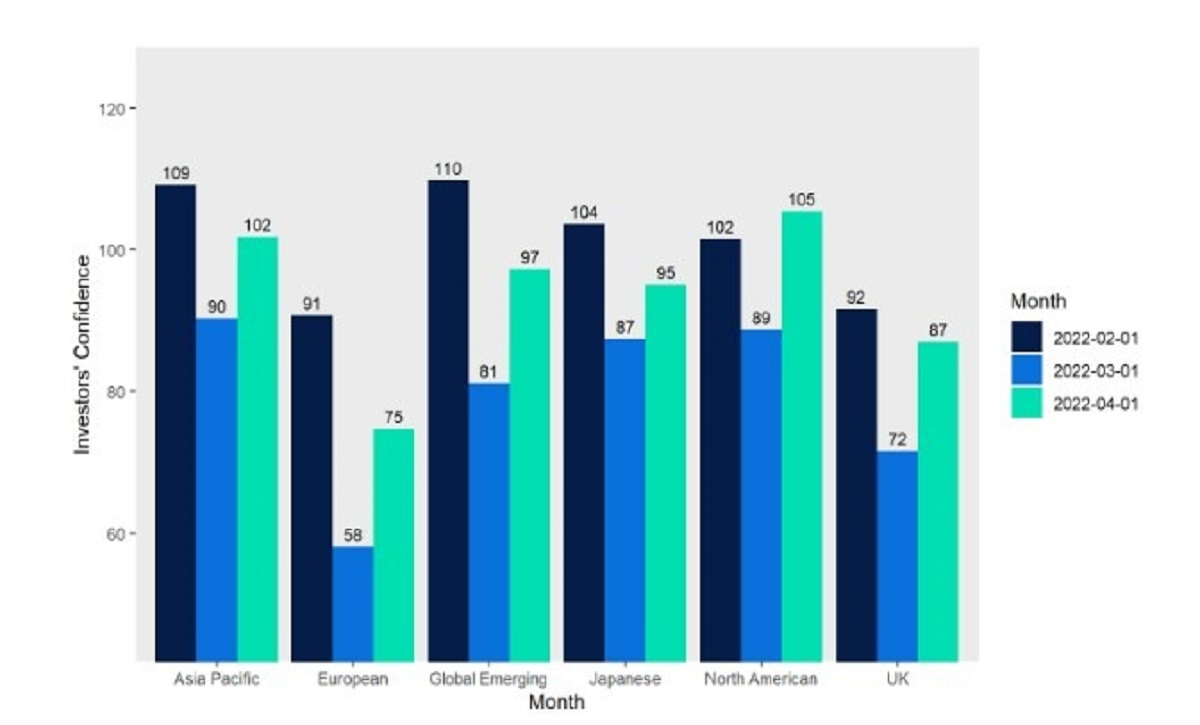

- Confidence increased in all regions

- After the biggest drop in March, confidence in the European sector registers the biggest increase this month

- Europe has rebounded but remains less favorable than Asia and the United States as uncertainty remains

First Quarter 2022 Hedge Fund Letters, Talks and More

“Investor confidence was shaken last month as the terrible events in Ukraine unfolded and the world struggled to make sense of the horror of war. During the first weeks of the dispute, market volatility increased and retail investors turned to perceived safe havens like gold, cash and total return funds that prioritize capital preservation. The most uncertain investment region was Europe, as investors feared the risk of contagion and the dependence of much of the continent on Russian energy supplies. This month, confidence is returning, but concerns remain over the uncertain outlook, with investors feeling more optimistic for markets in North America and Asia-Pacific. Fund flows over the past month reflect this, with investors buying US equity funds and global equity funds to diversify their geographic exposure.

BTG Pactual is positioned for an aggressive Fed hike and QT cycle

The BTG Pactual Rates fund posted a return of -0.17% for the first quarter, after returns of 0.14%, 0.19% and -0.5% for January, February and March, respectively. Tough times for rates In its March letter to investors, which was obtained by ValueWalk, the BTG Pactual Rates team said the first quarter brought significant rate movements. Read more

The BTG Pactual Rates fund posted a return of -0.17% for the first quarter, after returns of 0.14%, 0.19% and -0.5% for January, February and March, respectively. Tough times for rates In its March letter to investors, which was obtained by ValueWalk, the BTG Pactual Rates team said the first quarter brought significant rate movements. Read more

Top funds, months to April 22 (number of net purchases, in alphabetical order)

| Artemis World Income |

| Income of Artemis |

| American Baillie Gifford |

| Baillie Gifford Managed |

| Baillie Gifford Positive Change |

| Fund Founder |

| JPMorgan Emerging Markets |

| Asian income from Jupiter |

| Rathbone Global Opportunities |

| Troy Trojan (Class X) |

Investor Confidence – Global Sectors

The Investor Confidence Index is compiled by surveying customers on a monthly basis. Every month we send the Investor Confidence Survey to 6,000 random clients and there is a representative breakdown of our clients by age. On average, about 10% of customers respond.

Article by Emma Wall, Head of Investment Research and Analytics at Hargreaves Lansdown

About Hargreaves Lansdown

Almost 1.7 million clients trust us with £141.2 billion (as of December 31, 2021), making us the UK’s leading platform for private investors. Over 98% of customer activity occurs through our digital channels and over 600,000 access our mobile app each month.

Updated