[ad_1]

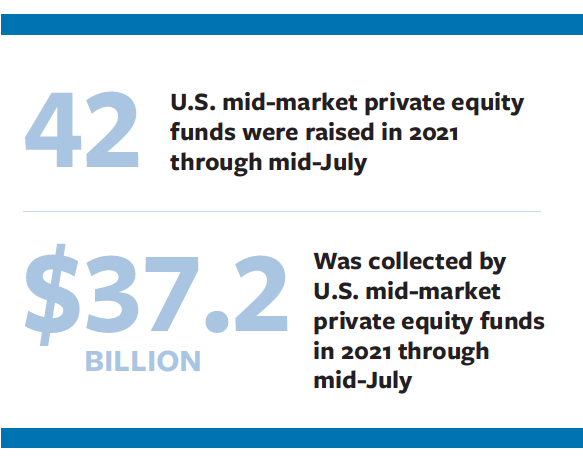

The private equity fundraising continues this year, undeterred by the pandemic. Forty-two mid-sized US private equity funds were raised from 2021 to mid-July, according to alternative investment data provider Preqin. These funds raised $ 37.2 billion against 77 funds and $ 68 billion over the whole of 2020. In 2019, the total raised was $ 50 billion out of 58 funds.

Some fund managers say it is difficult to woo new clients without face-to-face meetings, but they have continued to raise large sums of money from existing investors.

Of the seven funds highlighted in Middle Market DealMakerInaugural fundraising report, three were household names in Chicago, considered by many to be the heart of middle-market investing.

Darlings of the windy city

Madison Dearborn Partners closed its eighth fund at its $ 5 billion cap in June, according to Pensions and investments. The company has been investing in mid-market US businesses since 1992 and takes its name from the location of its offices at the intersection of Madison and Dearborn streets in downtown Chicago.

Pritzker Private Capital raised $ 2.7 billion for its third fund in July. The company is the investment arm of the wealthy Pritzker family who built their fortunes by founding and expanding Hyatt hotels. The money for the fund was raised from other family offices, LPs and international investors. The Pritzkers are long-time Chicago area investors and entrepreneurs. JB Pritzker is currently Governor of Illinois, while his brother Anthony Pritzker runs the investment firm.

It is very difficult to meet someone virtually for the first time, to build that trust and to convert them into a new investor.

Ben magnano

Managing Partner, Frazier Healthcare Partners

Also in Chicago, Wind Point Partners, which started in 1984, closed its last fund with $ 1.5 billion in February. The company touts its executive network of former CEOs of public and private companies, who provide information to portfolio companies.

Investment objectives

Even though these fund managers raise larger and larger funds and may close larger deals, many still focus on the mid-market, with Wind Point targeting enterprise value companies in the $ 100-500 million range.

Pritzker Private Capital has a broad band around its target size which includes the middle market. The company’s sweet spot is between $ 200 billion and $ 1.5 billion worth of electric vehicles, said Michael Nelson, chief investment officer.

Part of what draws investors to Pritzker is the company’s 20-year history of building businesses, Nelson says. “This is paired with 45 investment and operations professionals,†he adds, which sets Pritzker apart from small family-owned investment firms.

Pritzker typically targets manufacturing, food, packaging, healthcare, and specialty materials companies. “We see opportunities that many others don’t see and most of our investments are made outside of the auction process,†says Nelson. The company generally invests in family businesses or those where management teams are important stakeholders.

The PPC III fund has made two investments to date: ProAmpac, a Cincinnati-based flexible packaging company that specializes in foodservice and retail, and Vertellus, an Indianapolis-based specialty chemicals manufacturer. Nelson says his company has been drawn to ProAmpac’s “strong management team and focus on sustainability,†because most of its materials are recyclable.

Investors in the PPC III fund were all loyal clients of the previous PPC II fund, which raised $ 1.5 billion in 2018. The company has expanded its client base among European and Asian investors in recent years, Nelson said.

Like Pritzker Private Capital, Seattle-based Frazier Healthcare Partners has also seen more investment from international LPs, according to Ben Magnano, managing partner of the company. Frazier closed its 10th fund at $ 1.4 billion in May. The company invests exclusively in health. The sweet spot for its target companies is around $ 20-40 million in EBITDA.

Most of our transactions are concluded outside of the auction process.

Michel nelson

Head of Investments, Pritzker Private Capital

Over the last two funds, Frazier’s client base has grown significantly among investors in Europe, Asia and the Middle East. They now represent around 35% of the LP base, compared to 15% previously. Most of the recent fund’s LPs are takeovers, Magnano says, because it’s hard to find new investors that Frazier executives haven’t met in person. “It is very difficult to meet someone virtually for the first time, to build that trust and convert them into a new investor,†says Magnano.

Nonetheless, the recent fundraising effort has been successful, with the current fund raising almost double its predecessor of $ 800 million. The company is currently focusing its investment efforts on technology-based healthcare and pharmaceutical services.

Frazier’s first investment in the new fund was the purchase of a 50% stake in CSafe Global. The Dayton, Ohio-based company provides cold storage and shipping services to pharmaceutical and life science companies. “CSafe telemetry solutions allow customers to know where their products are at any time in real time,†says Magnano.

More recently, Frazier’s portfolio company, North Carolina-based Parata Systems, acquired another pharmaceutical automation company, Quebec-based Synergy Medical. Parata offers a range of packaging solutions in blister packs, sachets and vials delivered via high speed automated robotic dispensers.

More recently, Frazier’s portfolio company, North Carolina-based Parata Systems, acquired another pharmaceutical automation company, Quebec-based Synergy Medical. Parata offers a range of packaging solutions in blister packs, sachets and vials delivered via high speed automated robotic dispensers.

Collectors from coast to coast

Shamrock Capital Advisors, an Los Angeles-based investment firm that raised $ 1 billion for its fifth fund in June, rounds out the list of notable mid-market fundraisers so far this year. The west coast company specializes in media, entertainment and communications.

On the East Coast, Crosspoint Capital Partners in Boston closed its first fund at $ 1.3 billion in April. The vehicle focuses on cybersecurity and infrastructure software. Senior management at the company is drawn from Symantec, other large technology companies and large private equity players such as Bain Capital, Thomas H. Lee Partners and HGGC.

Also on the East Coast, BBH Capital Partners, the private equity arm of investment bank Brown Brothers Harriman, has raised $ 1.2 billion for its sixth fund. BBH makes equity investments ranging from $ 40 million to $ 150 million. He pursues a diversified investment strategy that includes healthcare, technology, media, telecommunications and business services.

[ad_2]