A new survey exploring Valentine’s Day shopping trends and statistics has revealed an all-time high in consumer spending in 2022. (iStock)

While many people see Valentine’s Day as a moneymaker for greeting card companies, love is still in the air for millions of romantics planning to celebrate the holiday this year.

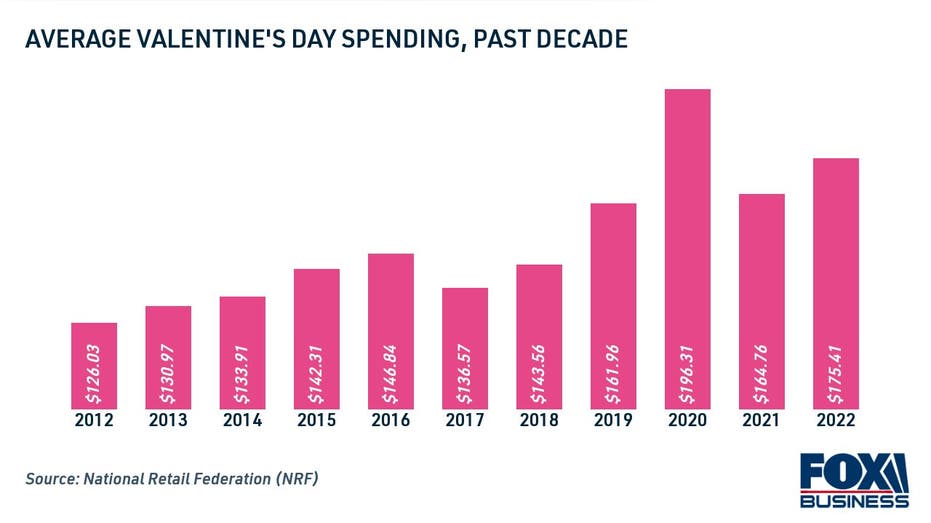

More than half (53%) of Americans plan to celebrate Valentine’s Day in 2022, spending around $175 on average, according to an annual survey of the National Retail Federation (NRF). Of those celebrating, 76% said it was important to do so given the current state of the coronavirus pandemic.

“Valentine’s Day is a special occasion for many Americans, especially as we emerge from the pandemic, and retailers are ready to help them mark this holiday in memorable and meaningful ways,” said the President and CEO. of NRF executive Matthew Shay.

Spending on Valentine’s Day is expected to reach $23.9 billion in 2022, the second highest year on record. Shoppers will spend an average of $175.41 this year, up slightly from $164.76 last year, but still well below the series high of nearly $200 in 2020.

Keep reading to learn more about spending on Valentine’s Day this year, as well as how you can fund a gift for your loved one. You can compare rates on a variety of financial products, from credit cards to personal loans, for free on Credible’s online marketplace.

NEED MONEY FOR HOLIDAY EXPENSES? HERE ARE 3 WAYS TO BORROW STRATEGICALLY

The most popular gifts this Valentine’s Day

The most popular Valentine’s Day gifts this year are candy (56%), greeting cards (40%) and flowers (37%), according to the survey. Nearly a third (31%) of respondents who celebrate the holidays plan to take their Valentine’s Day on a date, up slightly from last year (24%) but still below pre-pandemic levels.

“While traditional Valentine’s Day gifts like candy and flowers never seem to go out of style, gift givers and recipients are more comfortable going out for a special meal or partaking in a new experience than ‘they weren’t a year ago,’ said Prosper Insights Executive. Vice President Phil Rist.

Spending on jewelry is estimated at an all-time high of $6.2 billion, with around a fifth (22%) of gift givers planning to buy jewelry for their loved one.

If you’re planning to surprise your Valentine with an extravagant gift like a diamond ring, be sure to spend wisely to avoid incurring unnecessary high-interest debt. One way to pay for jewelry without paying interest is to use a credit card with a 0% APR introductory period. You can compare credit card offers on Credible for free without affecting your credit score.

70% OF CONSUMERS IN AMERICA GO OVER BUDGET ON HOLIDAYS, SURVEY SAYS

How to Finance Valentine’s Day Spending and Get Out of Debt

It can be tempting to overspend on Valentine’s Day gifts in the holiday spirit, but going into debt in the name of passion is unwise. The best gift for your loved one can be as simple as a home-cooked meal or a heartfelt love letter. But if you’re thinking of buying a gift for your Valentine, here are some ways to finance your purchase:

- Save and pay cash. It is generally necessary to avoid going into debt to finance unnecessary expenses, in particular Valentine’s Day gifts. One way to increase your savings is to open a high yield savings account. You can compare savings rates and open an account on Credible.

- Use buy now, pay later (BNPL) financing. Some online retailers partner with BNPL companies to offer their customers a way to split their purchase into installments at checkout. Keep in mind that while some BNPL providers do not charge interest or fees, some (like Affirm) may charge rates as high as 30% APR.

- Spend wisely if you use plastic. If you plan to put Valentine’s Day spending on your credit card, it’s important to pay the entire purchase before the statement due date to avoid racking up high interest charges. One way to avoid interest altogether is to use a credit card with a 0% APR introductory period – but note that these offers are generally reserved for applicants with excellent credit.

If you’re struggling to pay off high-interest credit card debt, consider using a personal loan for debt consolidation. The average interest rate on a two-year personal loan is at an all-time low of 9.09%, according to the Federal Reserve. Paying off credit card debt with an unsecured personal loan can save some borrowers up to $2,400 in interest charges, according to a recent analysis by Credible.

You can see your estimated personal loan offers from multiple lenders at once on Credible, so you can find the lowest possible interest rate for your financial situation.

GEN Z GENERALS AND GRADUATES PLAN TO CUT STUDENT LOAN PAYMENTS THROUGH REFINANCING

Do you have a financial question, but you don’t know who to contact? Email the Credible Money Expert at [email protected] and your question might be answered by Credible in our Money Expert column.