[ad_1]

Unmarried Americans prioritize homeownership over paying for a marriage, according to a new survey. (iStock)

Some of the most important stages in life, such as getting married and buying a house, are also life’s most important financial commitments. So when asked to choose between the two, a new survey has shown that many singles choose to buy a home rather than get married.

About 4 in 5 single Americans (82%) said they would rather invest in a home than pay for a big and expensive wedding, according to a new survey from Coldwell Banker Real Estate. This number is even higher among single women, at 85%.

Despite a competitive housing market, potential buyers are still determined to become homeowners, according to Coldwell Banker President and CEO Ryan Gorman. And he doesn’t expect this trend to slow down anytime soon.

“The 2021 housing market has been marked by low inventory and competition as Americans continue to keep home ownership in mind,†Gorman said. “Our latest survey suggests that with generations of all ages and backgrounds prioritizing home ownership over other financial goals, this seller’s market may continue until 2022.”

Keep reading to learn more about homeownership and marriages, including tips on how to finance each. Then visit Credible to compare interest rates on a variety of financial products, such as mortgages and marriage loans.

WHAT ARE PROPERTY TAXES? A GUIDE FOR THE FIRST HOME BUYERS

Homeownership or a Marriage? You may not have to choose

A typical wedding costs almost $ 30,000, according to the American Marriage of Brides Study 2020. Such a large amount of money can make it difficult for couples to also be able to afford a down payment on a house, prompting them to choose between the two.

But since interest rates are currently low on a variety of financial products, it may be possible to both buy a house and pay for a wedding.

35% OF MILLENNIUMS INDICATE STUDENT LOAN DEBT PREVENTING THEM FROM BUYING A HOME

Mortgage rates remain historically low, making this a good time to buy a home

Strong demand from home buyers coupled with low home inventory is driving competition in today’s housing market, causing home values ​​to skyrocket. But despite rising home prices, now is the time to buy a home, thanks to historically low mortgage rates.

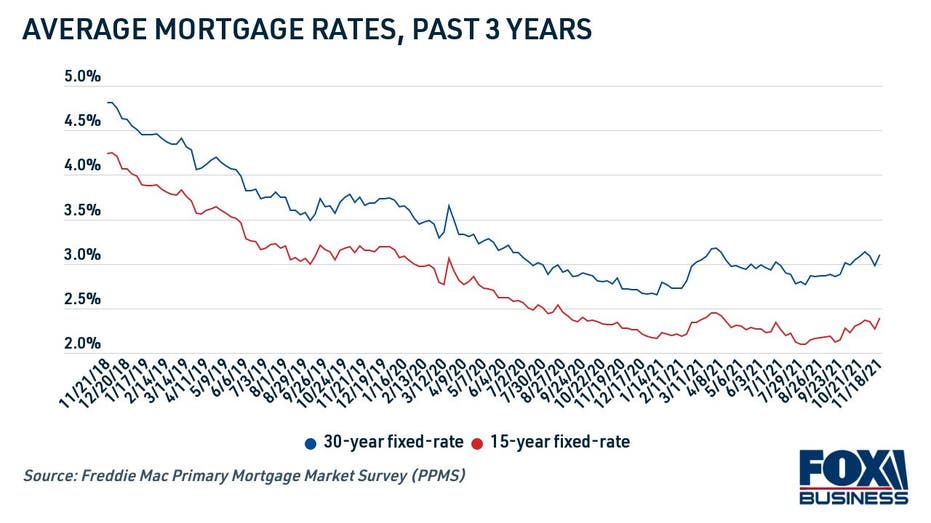

Over the past 3 years, the average rate on a 30-year fixed-rate home loan has dropped from nearly 5% to around 3%, according to data from Freddie mac. This makes the cost of borrowing a mortgage much more affordable in the long run. Plus, lower rates usually mean lower mortgage payments.

ARE THE MORTGAGE CLOSING FEES AN ALLOWABLE TAX DEDUCTION?

But interest rates cannot stay that low indefinitely. The Federal Reserve is forecasting a rate hike as early as 2022, which will inevitably lead to a spike in mortgage interest rates. And experts also agree, with the Mortgage Bankers Association (MBA) predicting that mortgage rates will average 4.0% in 2022 and 4.3% in 2023.

The time to lock in a low interest rate on a home loan is running out. If you are thinking of buying a home, get a mortgage prequalification for free on Credible. You can compare the rates of the best mortgage lenders, all without affecting your credit score.

CO-OWNERSHIP AGAINST EQUAL OWNERSHIP: WHAT TO KNOW ABOUT A SHARED HOUSE

New borrowing options make it easier to pay off a wedding

Marriage is not a prerequisite for buying a home, but couples can always consider getting married before becoming part owners. If you plan to have your (wedding) cake and eat it too, then it may be possible to finance your big day with a wedding loan. It is simply a type of unsecured personal loan used to pay for wedding expenses like ceremony and reception, or even a honeymoon.

Since personal loans do not require collateral, the funds can be used however you see fit. Personal loans are paid directly into your bank account as a lump sum of cash, and they are repaid in fixed monthly installments over a set period of time, usually a few years.

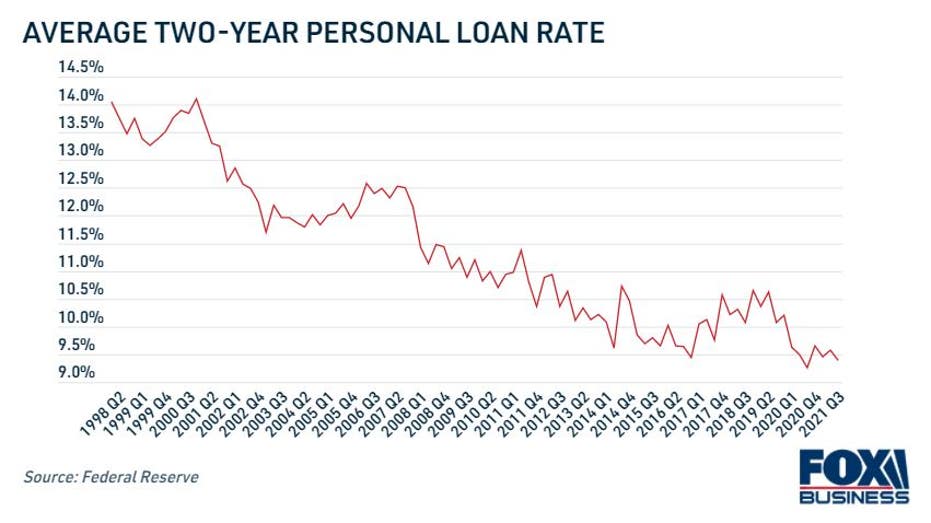

Personal loan interest rates are nearing all-time low, according to the Federal Reserve, making these loans a cheaper wedding finance option than ever before.

Keep in mind that borrowing money for unnecessary expenses is generally not advisable, and that includes a large wedding. You will have to pay interest on the loan, which increases the overall cost of hosting a wedding. Instead, you could save up front for your big day, even if that means postponing for a few years while you budget for costs.

If you decide to borrow a personal loan for your wedding expenses, it is important to compare the rates of several lenders to make sure you are getting the lowest possible rate for your financial situation. You can browse the personal loan offers tailored to your needs with a gentle credit check on Credible. Then use a personal loan calculator to estimate your monthly payments, fees, and other repayment terms.

BEST PERSONAL LOANS FOR BORROWERS WITH A COSIGNER

Have a finance-related question, but you don’t know who to ask? Email the Credible Money Expert at [email protected] and your question could be answered by Credible in our Money Expert column.

[ad_2]