[ad_1]

Our goal here at Credible Operations, Inc., NMLS number 1681276, referred to as “Credible†below, is to give you the tools and confidence you need to improve your finances. Although we promote the products of our partner lenders who pay us for our services, all opinions are ours.

View mortgage refinance rates for October 15, 2021, which are largely unchanged from yesterday. (iStock)

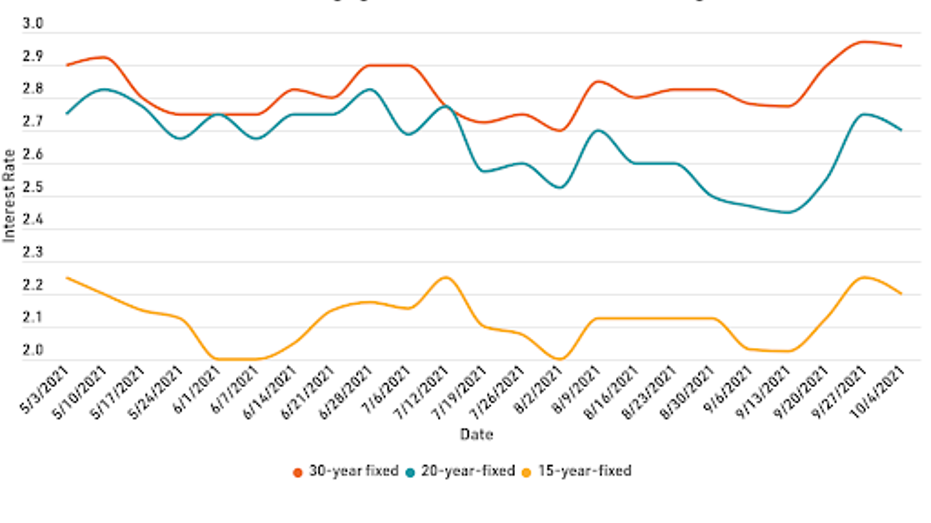

Based on data compiled by Credible, current mortgage refinancing rates have been flat for three terms since yesterday, with only 30-year rates edging up.

- Refinancing at a fixed rate over 30 years: 3.000%, against 2.990%, +0.010

- Refinancing at a fixed rate over 20 years: 2.750%, unchanged

- Refinancing at a fixed rate over 15 years: 2.250%, unchanged

- Refinancing at a fixed rate over 10 years: 2.125%, unchanged

Prices updated on October 15, 2021. These prices are based on the assumptions presented here. Actual rates may vary.

Mortgage refinance rates are generally higher than rates for new mortgages, but have kept pace throughout 2021. The current 30-year refinance rate hike follows the slow increase in purchase rates . While mortgage rates overall remain relatively low, homeowners might consider early-late refinancing rates ultra-low. Borrowers can still achieve significant interest savings and shorten their repayment terms by blocking 20, 15 or 10 year refinancing today.

If you are thinking about refinancing your mortgage, consider using Credible. Whether you want to save money on your monthly mortgage payments or consider refinancing with cash, Credible’s free online tool will allow you to compare rates from multiple mortgage lenders. You can see prequalified fares in as little as three minutes.

Current fixed refinancing rates over 30 years

The current rate for a 30 year fixed rate refinance is 3000%. It’s since yesterday. Refinancing a 30-year mortgage into a new 30-year mortgage might lower your interest rate, but might not have much of an effect on your total interest charges or monthly payments. Refinancing a short-term mortgage to a 30-year refinance could result in a lower monthly payment, but higher total interest charges.

Current 20-year fixed refinancing rates

The current rate for a 20 year fixed rate refinance is 2.750%. It’s the same as yesterday. By refinancing a 30-year loan to a 20-year refinance, you could earn a lower interest rate and lower total interest charges over the life of your mortgage. But you can get a higher monthly payment.

Current fixed refinancing rates over 15 years

The current rate for a 15 year fixed rate refinance is 2.250%. It’s the same as yesterday. A 15-year refinance might be a good choice for homeowners looking to strike a balance between lowering interest charges and maintaining a reasonable monthly payment.

Current fixed refinancing rates over 10 years

The current rate for a 10 year fixed rate refinance is 2.125%. It’s the same as yesterday. 10-year refinancing will help you pay off your mortgage sooner and maximize your interest savings. But you could also end up with a larger monthly mortgage payment.

You can explore your mortgage refinance options in minutes by visiting Credible to compare rates and lenders. Discover Credible and get prequalified today.

Rates last updated on October 15, 2021. These rates are based on the assumptions presented here. Actual rates may vary.

These rates are based on the assumptions presented here. Actual rates may vary.

If you think refinancing is the right decision, consider using Credible. You can use Credible’s free online tool to easily compare multiple mortgage refinance lenders and see prequalified rates in as little as three minutes.

Prices updated on October 15, 2021. These prices are based on the assumptions presented here. Actual rates may vary.

Is Now a Good Time to Refinance?

Mortgage refinancing rates have been at historically low levels throughout the year. They are unlikely to drop much and there are already signs that rates are on the rise, as experts have predicted. But low rates aren’t the only factors that determine whether it’s time to refinance your home loan.

Everyone’s situation is different, but generally, it may be a good time to refinance if:

- You may be able to get a lower interest rate than you currently have.

- Refinancing will save you money over the life of your home loan.

- Your refinancing savings will ultimately exceed the closing costs.

- You know you will be staying in your home long enough to recoup the costs of refinancing.

- You have enough equity in your home to avoid private mortgage insurance (PMI).

If your home is in need of major and expensive repairs, now might be a good time to refinance to take some of the equity out to pay for those repairs. Just be aware that lenders usually limit the amount you can get out of your home for a cash refinance.

How to get your lowest mortgage refinance rate

If you want to refinance your mortgage, improve your credit rating, and pay off any other debt could guarantee you a lower rate. It is also a good idea to compare the rates of different lenders if you are hoping to refinance, in order to find the best rate for your situation.

According to a study by Freddie mac.

Be sure to shop around and compare the rates of several mortgage lenders if you decide to refinance your mortgage. You can do this easily with Credible’s free online tool and see your prequalified rates in just three minutes.

How does Credible calculate the refinance rates?

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the evolution of mortgage refinancing rates. Credible’s average mortgage refinance rates are calculated based on information provided by partner lenders who compensate Credible.

The rates assume that a borrower has a credit score of 740 and borrows a conventional loan for a single family home that will be their primary residence. Rates also assume zero (or very low) discount points and a 20% deposit.

Credible mortgage refinance rates will only give you an idea of ​​current average rates. The rate you receive may vary depending on a number of factors.

What are the reasons for refinancing?

Every borrower’s situation is different, but here are some great reasons to refinance:

- To get a lower interest rate – A lower interest rate could mean you’ll pay less interest over the life of your mortgage – provided you refinance for a shorter term as well.

- To shorten the repayment period – If your ultimate goal is to someday get rid of your mortgage, shortening the repayment period may help you get there sooner.

- To reduce interest charges over the life of the loan – Interest can be a significant part of the total cost of your mortgage. For example, if you borrow $ 250,000 at 3.5% for 30 years, your total interest expense would be $ 154,140. Refinancing at 2.75% for the same repayment period could save you $ 36,723 in interest charges.

- To withdraw equity in cash – Known as “cash-out refinancingâ€, this type of refinance allows you to take out a new mortgage for more than you owe on your old one and take the difference in cash. The equity in your home guarantees the extra money you can use for improvements, repairs, or other needs.

- To get a fixed mortgage rate – If you have taken out an adjustable rate mortgage, the very low initial interest rate may revert to a much higher rate at the end of the initial period. And after that, your rate may change with market conditions. Many homeowners with ARMs are looking to refinance themselves into fixed rate mortgages that can provide reliable payment at a predictable rate.

Conversely, some reasons for refinancing are less good:

- Using equity to pay off unsecured debt like a car loan or credit cards – If your interest rate on these types of credit is high and you can get a really low mortgage refinance rate, you might be thinking “Why not? But unsecured debt like personal loans or credit cards, and even a secured car loan, doesn’t put your home at risk. Paying off those debts by refinancing your home mortgage turns those unsecured debts into debt secured by your home.

- Using equity to invest – Using equity to invest puts your home at risk for something that is already a risky proposition. The investment does not involve any guarantee of return. Meanwhile, paying off your mortgage and preserving your equity has a dependably positive impact on your credit and finances.

- Using equity for a big purchase – If you have built up equity in your home, it can be tempting to tap it to get money for luxuries like a big trip, a motorhome, or even cosmetic surgery. But think carefully before you refinance with withdrawal for these reasons. A refinanced mortgage is long term debt.

Credible is also a partner of a home insurance broker. If you are looking for a better home insurance rate and are considering switching providers, consider using an online broker. You can compare quotes from the top rated insurance companies in your area – it’s quick, easy, and the whole process can be done entirely online.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question could be answered by Credible in our Money Expert column.

As a credible authority on mortgages and personal finance, Chris Jennings has covered topics such as mortgages, mortgage refinancing, and more. He was an editor and editorial assistant in the online personal finance field for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.

[ad_2]