[ad_1]

While US stocks are somewhere between 3% and 5% of their highs, depending on which market you are looking at, bullish sentiment in stocks is not as strong as it was a few months ago. The S&P 500 is trading closer to its 200-day moving average today than it has since July 2020 and with the Fed looking to tighten conditions soon, it makes sense that investors have slowed their pace a bit. enthusiasm.

However, some segments of the market appear to be oversold in the short term. Since investing is often a mean reversion game, there are potential short-term opportunities to be seized here.

Note: Want to receive periodic email notifications when articles are posted here? Drop your email in the box below!

Here are three ETFs whose Relative Strength Indicator (RSI) is currently below key level 30.

IShares Biotechnology ETFs (IBB)

When cyclicals took over from growth stocks about a month or two ago, defensive sectors were left behind. Utilities rebounded, consumer staples at least managed to keep up with the S&P 500, but real estate and health care were the two biggest laggards.

If the general health sector isn’t popular with investors, the comparatively riskier biotech sector is probably doing even worse and that’s exactly what we’re seeing here. IBB is sitting around 12% of its high today after failing to breach the $ 175 level twice this year.

Healthcare is a big headline industry and we just haven’t seen this group getting a lot of attention. Sure, prescription drug prices have been mentioned here and there, but that’s almost all the Fed, interest rates, inflation, and debt in the news. COVID vaccines are still a thing, but they became the news yesterday.

At the macro level, it’s hard to find a catalyst here because investors are just more concerned with other things. The decline that has occurred over the past 2-3 weeks has been brutal, but it looks like it could develop a base and could be on the verge of averaging shortly.

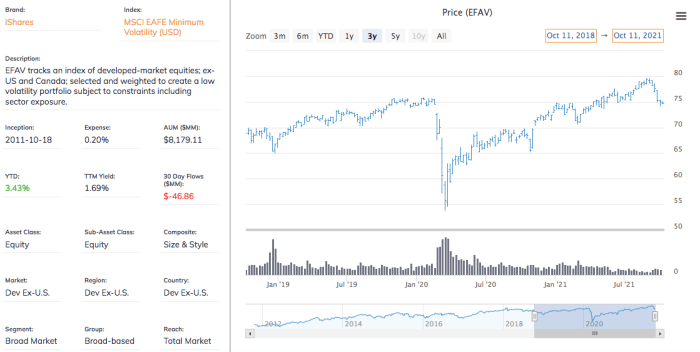

iShares MSCI EAFE Minimum Volatility Factor ETF (EFAV)

The EFAV presents not one, but two themes that have been relatively unappreciated by investors. International stocks have posted mostly stable gains from the low point of the COVID recession, but they have also consistently managed to keep up with the S&P 500. The minimum volatility factor, as has been the case with defensive sectors, has sparked a lot of interest since growth and cyclicals have been the two market sectors that have dominated the market.

Now that we are seeing particular strength in the dollar from rising interest rates, international stocks have another catalyst that keeps them even further behind US stocks. I think it’s more likely than not at this point for yield spreads to stay at their current levels or even widen further, creating another headwind for foreign stocks.

The decline in equities we’ve seen recently is at least in part due to inflationary pressures and the uncertainty surrounding what global central banks will do about interest rates and bond purchases. These factors do not disappear either. If inflation and supply chain issues remain persistent, or if central bank hands are forced earlier than expected, investors could start to turn to defense fairly quickly.

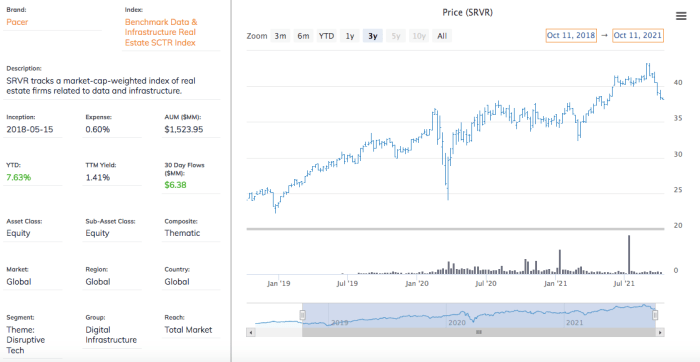

Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (SRVR)

Real estate has been one of the best performing market sectors since the start of last year, but this uptrend has been halted. The latest cuts have coincided closely with the rise in Treasury yields, so any further rate hikes could exacerbate this trend.

REITs are in a position where you have to be picky because the risk / reward profiles seem so different at the sub-sector level. Data centers and infrastructure REITs, in my opinion, remain one of the best potential opportunities in the industry and the latest downturn creates a bargain buying opportunity.

The low yield of this ETF is not necessarily what you would expect from a REIT portfolio, but it is a rapidly growing space and the real opportunity here comes from capital growth, and not dividend income.

Note: Want to receive periodic email notifications when articles are posted here? Drop your email in the box below!

[ad_2]